- Confiándonos su propiedad, le aseguramos efectividad

- +562 2840 0499

- contacto@starkingpropiedades.cl

Liabilities cover anything from funds, membership payable, mortgages, deferred profits and accrued expenses, all of these generate providers deals far better

Starburst Galaxy online spielen, Starburst Maklercourtage von NetEnt

14 de enero de 2025Kelly Oram: Starburst Effect

14 de enero de 2025Liabilities cover anything from funds, membership payable, mortgages, deferred profits and accrued expenses, all of these generate providers deals far better

Liabilities: The latest courtroom bills otherwise loans owed of the a friends one arise during the course of providers procedures. Talking about paid throughout the years through the import of money, products or properties. Latest liabilities is costs payable in one 12 months, while a lot of time-name debts try more than a longer period of time.

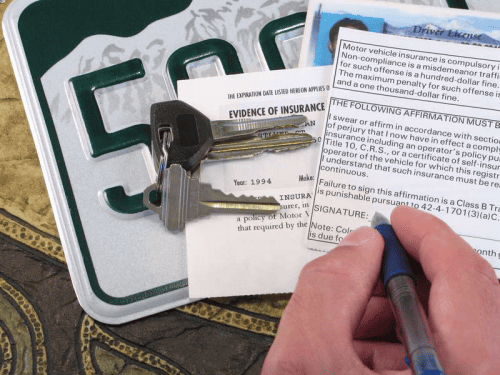

Lien: Brand new right away from a collector to market the latest collateral property regarding a debtor who maybe not meet the obligations of a great loan offer. Good lien is generally a motor vehicle loan – one that’s put-out in the event the auto are paid-in complete – otherwise an excellent mechanic’s lien, that may be connected to a home in the event the a citizen does maybe not shell out a company getting characteristics rendered. There are even federal income tax liens if a citizen does not spend possessions taxes due. If the debtor doesn’t pay back the money owed, the home would be auctioned out over pay the lien manager.

Mortgage Administrator: A real estate agent away from a lender, borrowing from the bank relationship or any other lender you to finds and helps individuals in acquiring both consumer or mortgages

Lien Waiver: A file available with a builder, subcontractor supplier and other party holding a good mechanic’s lien one states any debts were paid-in complete and you may waiving upcoming lien rights to your possessions. There are four variety of lien waivers: step one. Unconditional waiver and you may discharge on progress payment: This discharges every claimant liberties through a certain date and you may boasts zero stipulations. 2. Conditional waiver and you can launch abreast of advances payment: It discharges the claimant rights due to certain times delivering payments have already been both acquired and canned. step 3. Unconditional waiver and launch up on finally percentage: As commission has been received, the new claimant launches the rights. cuatro. Conditional waiver and you may release abreast of final percentage: Takes away all of the claimant rights through to bill of fee with specific arrangements.

Loan: The fresh operate away from providing money, assets or any other material items to a different team with the hope away from future payment of the principal number and additionally people attention otherwise costs agreed upon by each party. Financing may either end up being for a one-date lump sum payment from an open-ended borrowing so you’re able to a selected roof number.

Mortgage underwriters, certified financing officers, get to know and asses the creditworthiness off possible consumers to establish if or not it be eligible for that loan

Mortgage Origination Commission: An initial percentage recharged from the a loan provider for control an alternative loan application. They are often anywhere between 0.5 and you can 1 percent of your complete mortgage, and are also made use of just like the payment getting placing the loan on put.

Financing Servicer: The government from financing. Upkeep occurs from the time the continues are distributed until the mortgage try paid back and includes giving payment per month comments, event monthly obligations, keeping fee and balance suggestions, event and https://paydayloansconnecticut.com/indian-field/ you can investing taxation and you may insurance, remitting funds into the note-holder and you can pursuing the through to delinquencies.

Mortgage to help you Well worth (LTV) Ratio: A lending exposure assessment ration utilized by loan providers to determine whether or not a loan should be given. Assessments with a high LTV rates are named greater risk and you may, if the mortgage become approved, the financial institution tend to fees alot more within the notice otherwise charge towards the loan.

Lock-In: A position you to departs a trader both hesitant or unable to hop out the right position on account of legislation, fees otherwise penalties with the performing this.

Lock-inside Several months: The brand new windows of your time when dealers of a directly-kept resource automobile, particularly a hedge fund, commonly allowed to get otherwise promote shares. It will help profile executives avoid liquidity problems whilst capital is positioned to get results for the investment. Its widely used inside security markets to have newly-granted societal offers and usually persists from 90 so you’re able to 180 weeks to eliminate shareholders which have the great majority of possession off ton the business from inside the initial trading months.