- Confiándonos su propiedad, le aseguramos efectividad

- +562 2840 0499

- contacto@starkingpropiedades.cl

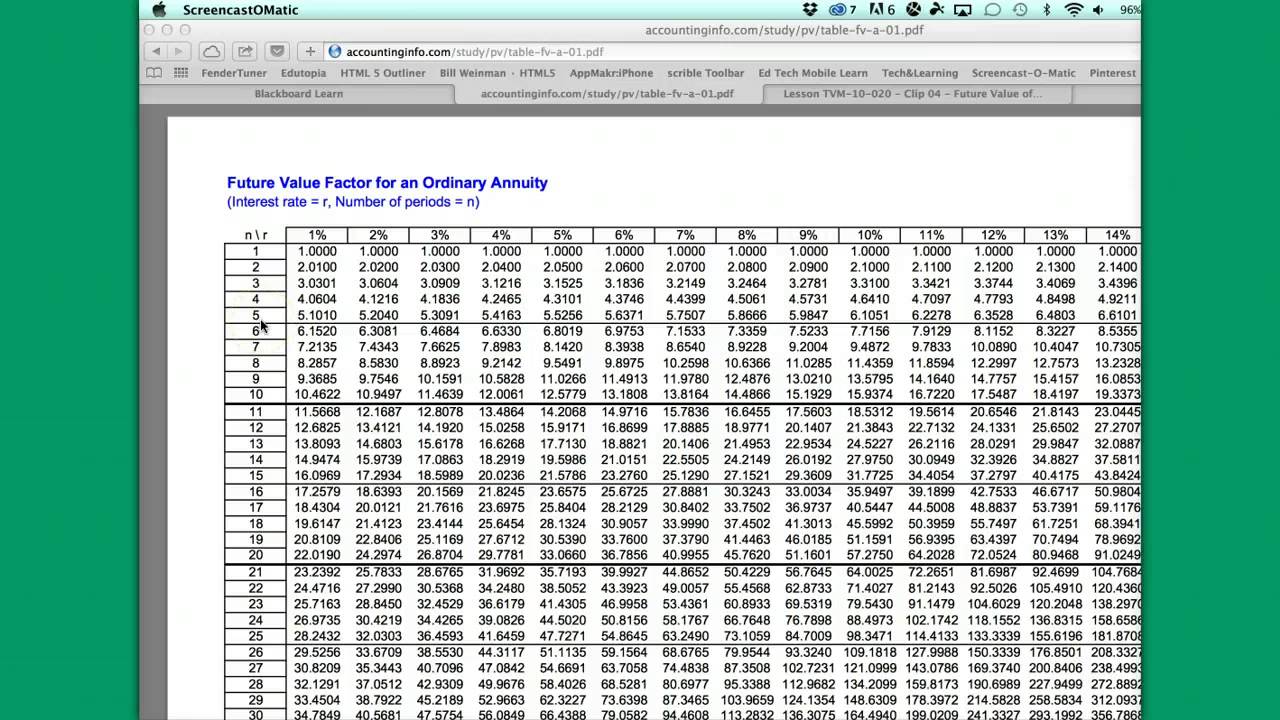

Annuity Present Value PV Formula + Calculator

Cash Basis Accounting vs Accrual Accounting Bench Accounting

31 de agosto de 2021What is fintech financial technology?

29 de septiembre de 2021Annuity Present Value PV Formula + Calculator

We can differentiate annuities even further based on whether they are deferred or immediate annuities. This type of annuity operates as a pension plan and is designed for people who are already retired and are looking for a guaranteed retirement income. Choose whether you would like to calculate the present value of an annuity starting with a future lump sum or starting with future payment amount, then enter the corresponding future value. The present value (PV) of an annuity is the current value of future payments from an annuity, given a specified rate of return or discount rate. It is calculated using a formula that takes into account the time value of money and the discount rate, which is an assumed rate of return or interest rate over the same duration as the payments.

How is the PV of Annuity Formula derived?

A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the «Data» tab, this line will list the name you gave to that data record. If no data record is selected, or you have no entries stored for this calculator, the line how to get an ein business tax identification number will display «None». Or, if you would like to calculate the future value of an annuity, please visit the Future Value Annuity Calculator — which also includes answers to What is Annuity? Another problem with using the net present value method is that it does not fully account for opportunity cost.

4: Present Value of Annuities and Installment Payment

However, you can adjust the discount rate used in the calculator to compensate for any missed opportunity cost or other perceived risks. Another advantage of the net present value method is its ability to compare investments. As long as the NPV of each investment alternative is calculated back to the same point in time, the investor can accurately compare the relative value in today’s terms of each investment.

Present Value of a Perpetuity (t → ∞) and Continuous Compounding (m → ∞)

You make a payment at the first of each month, and each month thereafter on the same date, until the end of the defined term. Deferred annuities usually earn interest and grow in value, so that to delay the payment by several years increases the payout of the monthly payments. People yet to retire or those that don’t need the money immediately may consider a deferred annuity. If you read on, you can learn what the annuity definition is, what is the present value of annuity as well as how to use this annuity payment calculator.

- In other words, we are comparing the future values for both Mr. Cash and Mr. Credit, and we would like the future values to equal.

- You can learn more about compound interest with our compound interest calculator.

- It means the project’s cash outflows outweigh the cash inflows when adjusted for the time value of money.

- Choose whether you want to enter a future lump sum or a payment amount, and enter the corresponding amount.

- Just to clarify, in the following annuity formulas, we refer to the ordinary annuity.

The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts. Use the filters at the top to set your initial deposit amount and your selected products. The present value of an annuity is the present cash value of payments you will receive in the future.

So if you have a question about the calculator’s subject, please seek out the help of someone who is an expert in the subject. If you are not sure what present value is, or you wish to calculate present value for a lump sum only, please visit the Present Value of Lump Sum Calculator. Present value can also be used to give you a rough idea of the amount of money needed at the start of retirement to fund your spending needs. You’ll then compare that to what you have saved now – or what you think you’ll have saved by your retirement date – and that gives you a rough idea of whether your savings is on track or not.

This field should already be filled in if you are using a newer web browser with javascript turned on. If it’s not filled in, please enter the web address of the calculator as displayed in the location field at the top of the browser window (-online-calculator-use.com/____.html). If it’s not filled in, please enter the title of the calculator as listed at the top of the page. If you have a question about the calculator’s operation, please enter your question, your first name, and a valid email address. All calculators have been tested to work with the latest Chrome, Firefox, and Safari web browsers (all are free to download).

Discover the scientific investment process Todd developed during his hedge fund days that he still uses to manage his own money today. It’s all simplified for you in this turn-key system that takes just 30 minutes per month. The reader should note that the original amount of the loan is not mentioned in the problem. Selecting «Stick» will keep the panel in view while scrolling the calculator vertically. If you find that annoying, select «Unstick» to keep the panel in a stationary position.